The Bill is Coming Due: AI Debt, Instacart's Pricing Collapse & The 2026 Reckoning

Explore the $125B AI infrastructure debt boom, Instacart's failed pricing experiments, and foldable phones reshaping hardware. 2026 demands clarity over hype.

The first fire of creation is over. The one that burned on pure possibility. Now, the smoke clears. And we are left with the quiet, structural work of what comes next. A different kind of fire. The kind that forges, not just consumes. This is the new reality. The Bill is Coming Due. And it’s arriving faster than anyone expected.

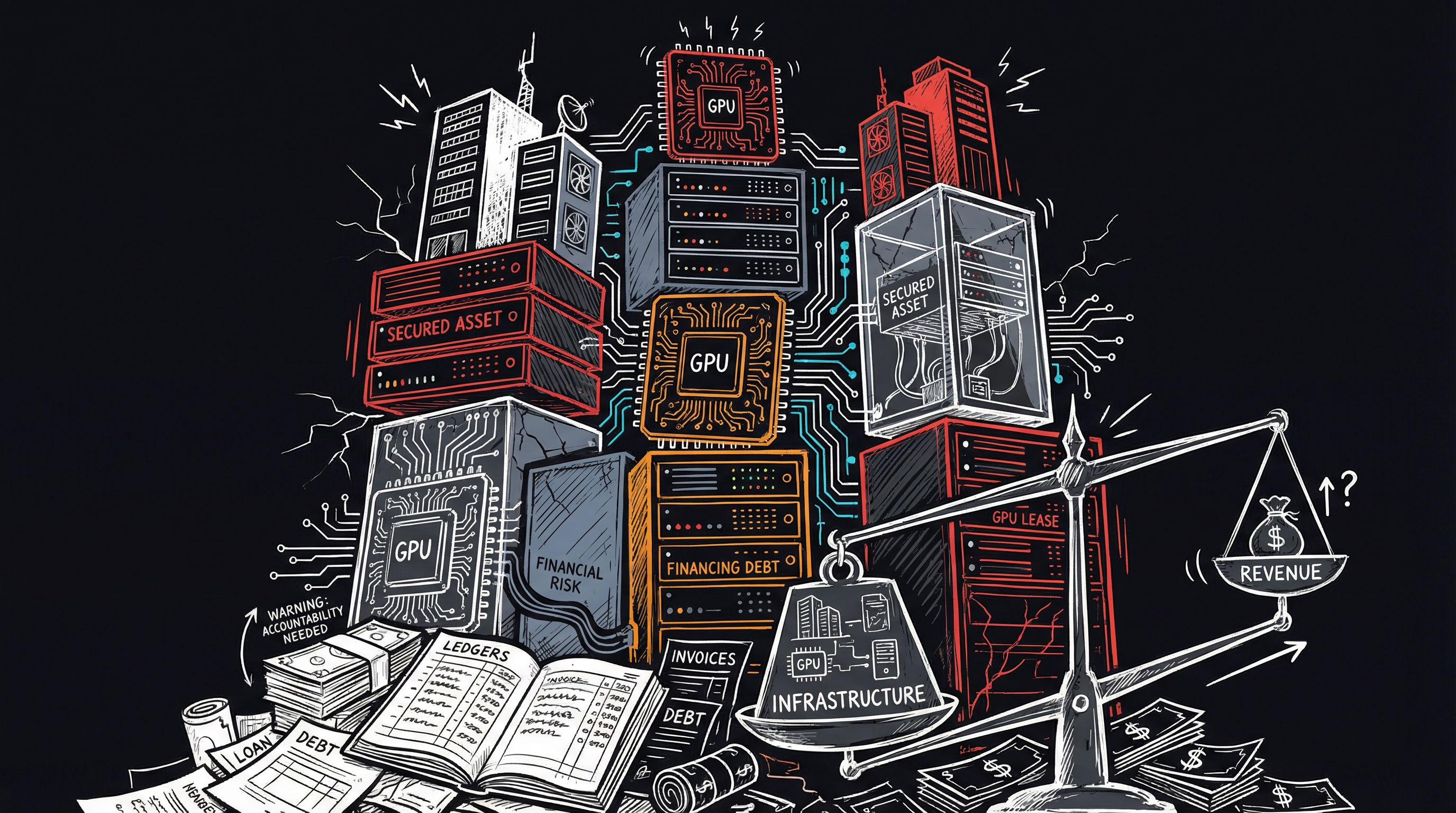

The Lead: The Invisible Debt Fueling the AI Data Center Boom

I’ve been watching the AI space with a sense of awe and unease. The awe remains. The unease has sharpened into clarity. The foundational concern has moved from speculation to documented fact.

In 2024, AI data center financing was $15 billion. In 2025, it surged to $125 billion—a 733% increase in a single year. Morgan Stanley now estimates private credit markets could contribute over half of the $1.5 trillion required for data center expansion through 2028. Goldman Sachs projects approximately $736 billion in AI infrastructure investment by the end of 2026. These aren’t side bets anymore. They’re the central economy.

The structure remains what I warned about: a closed loop. Companies are using the very chips they need to operate as collateral for loans. It’s leverage dressed up as innovation. Applied Digital, a data center company, was forced to pay an additional 8.75 percentage points in interest—70 percent higher costs—just to secure financing. The market is speaking. It’s not saying confidence. It’s saying caution.

The Bank of England has explicitly warned that escalating debt in AI infrastructure expansion could amplify financial stability threats if valuations adjust. Translation: when reality doesn’t match the hype, the system becomes fragile. They’re not being alarmist. They’re being honest.

Here’s what matters most: the foundation is being built on timing, not on delivered value. Data centers require 18 to 24 months to construct. Chip orders are placed years in advance. But demand forecasts shift in a quarter. You’re essentially building infrastructure for a future you can’t see yet. If that demand doesn’t materialize, or if it materializes slower than the debt schedule requires—the bill comes due in a very real way.

The great paradox: everyone knows this is the structure. The market is still funding it anyway. That’s not confidence. That’s momentum.

The Structural Cracks

Accountability Becomes Non-Negotiable

Instacart tested a boundary and found it immediately.

In December 2025, Consumer Reports and Groundwork Collaborative released an investigation revealing that Instacart had been running AI-powered pricing experiments using its Eversight tool. The results: some customers were charged up to 23% more for identical items. The average difference was 13%—potentially costing households $1,200 annually.

What’s important here isn’t the price difference itself. It’s the pattern it reveals.

Instacart tested the limits of opaque automation and found a hard boundary: human trust. The bill came due in the form of public outcry, media investigation, and FTC scrutiny. On December 22, 2025—exactly two days after detailed reporting broke—Instacart announced it would end all pricing experiments effective immediately. Not next quarter. Not after review. Immediately.

This is the pattern we will see again and again: systems without clarity will be rejected. Retailers can still set their own prices. That’s fine. But the tool that allowed hidden, algorithmic price discrimination? Gone.

The lesson is structural. Trust is the only currency that actually matters. The moment you trade clarity for revenue optimization, you’ve already lost.

The Physical Reckoning

The whispers about Apple and Samsung moving towards wide-fold and tri-fold devices have solidified into confirmed development and upcoming launches.

In 2025, Samsung reclaimed momentum in the foldables space. The Galaxy Z Fold 7 finally caught up with Chinese competitors in durability and usability. More importantly, Samsung just announced the Galaxy Z TriFold—a genuinely new form factor coming to the U.S. in 2026. This isn’t iteration. This is structural change.

And Apple—after years of sitting out the category—is widely expected to launch the iPhone Fold in 2026. Not confirmed, but credible. If it happens, Apple enters with the brand power to reset expectations.

Here’s what this actually means: the old glass slab, a form factor from 2007, is no longer sufficient for the work we need to do. The software has outpaced the hardware. We need new physical structures to contain the overwhelming flow of information.

This isn’t about fashion. It’s about recognizing that attention itself has changed. The single-screen phone was designed for simplicity. We no longer live in simplicity. The move to foldable screens is an admission that the design of the device needs to change to reflect how people actually think and work.

It’s also a signal that hardware companies are finally willing to take structural risk again. Not everything will be a flat glass rectangle. That era is ending.

The Signal in the Debt

Understanding the AI infrastructure debt matters more than understanding any single company.

CoreWeave, a company that leases data centers for AI operations, has structured much of its financing around contracts with major clients like OpenAI and Meta. The company understands that smaller market entrants can’t survive on speculation alone. They need contractual proof of demand.

This is smart. But it also reveals the dependency: the entire AI infrastructure financing market is built on the assumption that hyperscalers will continue to spend aggressively and on schedule. If that assumption breaks, everything else breaks with it.

The foundation matters most. Not the flashiest model. Not the fastest company. The foundation. The structure that says: we can actually pay for this.

What Changes Now

The pattern is clear. 2026 will be defined by a contraction in noise and a clarification of signal.

Three things are already in motion:

Debt markets are repricing risk. The easy money phase is ending. Companies with shaky fundamentals and big promises will face 70%, 100%, or higher interest premiums. This separates the real projects from the speculative ones.

Automation without trust is dead. Instacart learned this. Others will too. If you build a system that hides its logic from users, you’ve already built in an expiration date. The future isn’t opaque intelligence. It’s intelligent transparency.

Hardware and physics matter again. The idea that everything would converge into a cloud-based abstraction has failed. We need new physical forms. We need devices that match how humans actually work. Companies willing to invest in structural innovation (foldable phones, new chip architectures, novel form factors) will lead. Companies optimizing existing structures will follow.

The Invitation

The Bill is Coming Due isn’t a prediction. It’s a principle.

Systems built on invisible debt collapse when reality meets the balance sheet. Systems built on opaque logic collapse when humans realize they’re being manipulated. Systems built without structural integrity collapse when the first real shock arrives.

The companies that will thrive in 2026 are the ones building clarity into their foundation right now. Not later. Now.

If you’re watching this space—whether you’re building infrastructure, designing consumer products, or allocating capital—the question is simple: What are you building on?

If the answer is hype, timing, or borrowed energy, the bill is coming due.

If the answer is structure, clarity, and honest accounting, you’re already ahead.

Sources & Readings

Reuters - Five debt hotspots in the AI data centre boom: https://www.reuters.com/business/finance/five-debt-hotspots-ai-data-centre-boom-2025-12-11/[1]

LA Times - Instacart ends AI pricing test: https://www.latimes.com/business/story/2025-12-22/instacart-ends-ai-pricing-test-that-charged-shoppers-different-prices-for-the-same-items/[5]

Tom’s Guide - Foldable phones 2025-2026: https://www.tomsguide.com/phones/foldable-phones-had-a-big-year-in-2025-and-iphone-folds-arrival-in-2026-could-bring-even-bigger-changes[10]

NYT - AI Companies Borrow Billions, Debt Investors Grow Wary: https://www.nytimes.com/2025/12/26/business/ai-debt-investors.html[3]

Fortune - Instacart may be jacking up grocery prices: https://fortune.com/2025/12/10/instacart-may-be-jacking-up-your-grocery-prices-using-ai/[6]

CNBC - The year AI tech giants, and billions in debt, began: https://www.cnbc.com/2025/12/31/ai-data-centers-debt-sam-altman-elon-musk-mark-zuckerberg.html[4]

Consumer Reports - Instacart’s AI Pricing May Be Inflating Your Grocery Bill: https://www.consumerreports.org/money/questionable-business-practices/instacart-ai-pricing-experiment-inflating-grocery-bills-a1[7]

CNBC - Instacart ends AI pricing tests: https://www.cnbc.com/2025/12/22/instacart-ai-pricing-tests-increased-costs.html[8]

CBS News - Instacart to end AI price tests: https://www.cbsnews.com/news/instacart-ends-ai-price-testing-tool-eversight/[9]

Two Birds - GPU-Based Financing: https://www.twobirds.com/en/insights/2025/germany/gpubased-financing-in-the-global-data-center-market[2]

Ready to Transform Your Business?

Book your free strategy call and see how AI can work for you.

Book Strategy Call